CSP LEDs crawl toward delivering on SSL promise (MAGAZINE)

Chip-scale packaging technology has the potential to reduce LED component cost and provide SSL system-design advantages, explains MAURY WRIGHT, but the technology, borrowed from the mainstream semiconductor industry, has been slow to emerge commercially.

Chip-scale packaging (CSP) has been touted as the future of LEDs in general illumination applications. Proponents claim that the technology can both enable lower-cost components and offer advantages in solid-state lighting (SSL) system design. But the packaging schemes, or lack thereof, were first presented in the LED space more than two years back and shipping products are hard to find. Let's examine the state of CSP and how manufacturers are moving to deliver the claimed benefits.

Interested in more articles & announcements on LEDs & sources?

We should begin by defining the CSP moniker. The semiconductor industry has evolved continuously to minimize the packaging that surrounds the actual semiconductor die. First came surface-mount device (SMD) technology in which the device contacts were under the package, as opposed to protruding from the sides; such devices required automated assembly techniques with pick-and-place robots putting the components in position on a printed-circuit board (PCB) that was subsequently passed through a wave-solder machine or oven. SMD allowed much tighter packing of devices on a PCB. A move to placing near-bare die on a PCB, using CSP technology, increased density even more, eliminated packaging costs, and even improved thermal convection.

FIG. 1. The Lumileds CSP LEDs feature the exact same footprint as the LED die with solder pads added at the wafer level after epitaxial growth.

LEDs are following the same trend. Jy Bhardwaj, senior vice president of research and development at Lumileds, said a "CSP LED does not need an interposer." The LED comes off the semiconductor manufacturing line ready for assembly onto a PCB. Fig. 1 is a Lumileds CSP LED. Traditional LEDs would go from the semiconductor line to a packaging process where the die would be attached to an interposer such as a ceramic substrate, yielding a packaged LED or what our industry often refers to as an LED package. Note that "LED package" is an erroneous description in semiconductor industry parlance, because the LED die is actually assembled into a LED package constituting a packaged LED, but the term was established by the Illuminating Engineering Society (IES) and is widely used.

CSPs come to light

In the LED space, CSP technology entered the scene at Strategies in Light (SIL) in 2013 when Lumileds (then Philips Lumileds) announced blue emitters in a CSP form factor. Those LEDs were in exactly the same footprint as the bare die and were intended for sale to outside customers that had the expertise to design and manufacture SSL products capable of working with the CSP components. Moreover, Lumileds said at the time it would design and manufacture modular light engines, or essentially PCBs with CSP LEDs installed, for a variety of applications. Such a business is often referred to as a Level 2 engagement with an SSL manufacturer in which the customer buys modules rather than LED components.

FIG. 2. The CSP structure and flip-chip LED architecture is far simpler than the traditional mid-power approach and will deliver performance benefits on top of cost advantages, according to Samsung.

At SIL 2014 in a keynote presentation, Samsung indicated that it would move into the CSP space using the technology as a way to evolve mid-power LEDs to yield more lumens per dollar. At the time, the company said CSP technology would allow the company to boost the power level at which mid-power LEDs operate to beyond 1W, halving the number of packaged LEDs required in a typical application such as a 60W-equivalent A-lamp. The diagram in Fig. 2 depicts the proposed Samsung CSP architecture compared to a legacy mid-power LED.

The potential cost advantage to the CSP architecture seems relatively simple. For starters, you can eliminate the separate step of having manufactured LEDs go through a packaging line. Moreover, there is the possibility that more steps of the manufacturing process can be carried out at the wafer level as opposed to at the individual die level after the chips are singulated.

For example, Bhardwaj said Lumileds installs the solder or bond pads at the wafer level just after the epitaxial stage of manufacturing using semiconductor etching and metallization techniques. The LEDs are subsequently singulated. The LEDs are ready for installation on a PCB when the wafer is diced. Bhardwaj also said Lumileds is able to redistribute the solder pads, generating a perfectly symmetrical footprint while he said some other flip-chip LEDs have irregular pads based on the LED structure.

For now, Lumileds is handling phosphor deposition on the individual LEDs after singulation. A touted benefit of CSP and wafer-level packaging technology is phosphor application using sheets at the wafer level, further reducing manufacturing costs. But it's not clear when that technology will be commercially viable.

Obstacles to CSP

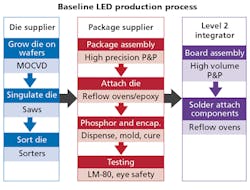

Not everyone buys the advantages of CSP, however. In a session at SIL 2015, Cree, Lumileds, and SemiconLight debated the merits of CSP. Paul Scheidt, leader of LED product marketing at Cree, said CSP technology mainly shifts tasks from the package supplier to the die supplier.

FIG. 3. Cree presented the LED manufacturing steps at Strategies in Light, and said moving the phosphor, encapsulation, and testing steps to the main manufacturing stage would overburden LED manufacturers.

Scheidt showed the chart in Fig. 3 that depicts the typical LED production process. He said CSP technology does eliminate the package assembly and die attach stages. But the LED manufacturer has to undertake the phosphor and encapsulation steps and the testing, along with adding the metal contacts. Scheidt said the burden to LED manufacturers is significant. Moreover, he said the absence of the ceramic substrate hurts system-level thermal performance and optical performance suffers with the CSP technology as well.

Momentum in the market

It appears, however, that CSP technology has gained quite a lot of momentum among LED makers. After the Lumileds and Samsung announcements, a number of other companies made CSP announcements starting at Light+Building 2014. Indeed, Toshiba, LG Innotek, Seoul Semiconductor, Epistar, and Lextarall exhibited early-stage CSP LEDs.

There remains a major difference, however, in the Lumileds CSP philosophy and the other potential CSP manufacturers, including Samsung. All but Lumileds are pursuing CSP technology as a way to improve the performance of mid-power offerings - essentially replacing traditional mid-power packaged LEDs going forward. Lumileds is applying CSP technology to high-power LEDs and believes the CSP technology will allow high-power LEDs to scale down and serve many applications being dominated by mid-power LEDs today. Bhardwaj made that point repeatedly in his keynote at SIL 2015.

When Bhardwaj discusses CSP LEDs, he frequently uses the word "scale," in the connotation previously mentioned and in another way. He believes CSP technology will enable standardized form factors for high-power LEDs just as package standards set in the display backlight area enabled many manufacturers to offer compatible and almost interchangeable mid-power LEDs. That type of scale could help lower component cost through manufacturing volume. Bhardwaj said, "I still believe it's the next big thing in LED packages."

Technical merits

Assuming that CSP will deliver advantages in component cost, it's also fair to ask how the LEDs will compare with traditional mid- and high-power packaged LEDs. Mid-power LEDs, with a large epitaxial area relative to lumen output, are acknowledged to have the highest efficacy measured in lumens per watt (lm/W). But that efficacy comes with low drive currents and a less efficient use of epitaxial real estate. Moreover, the plastic-packaged mid-power LEDs are limited in terms of current drive or power and can't be overdriven the way ceramic-packaged high-power LEDs can. Of course, higher driver current reduces efficacy but also can reduce the number of LEDs required in any given product.

We asked Jacob Tarn, executive vice president at Samsung, how the Samsung CSP LEDs will compare with the company's existing mid-power line. He said the initial CSP offerings, which he refers to as CSP2, will match the ubiquitous 3030-package components on the market in terms of baseline efficacy and lumen output. But he added, "These CSP LEDs will be able to deliver a wider overdrive range with less droop and more product variety."

Lumileds' Bhardwaj said the performance comparison depends on application. The basic Lumileds CSP LED emits from five surfaces - the four sides and the top. And today, Lumileds is not adding a primary optic on the LEDs. For applications that benefit from a broadly distributed beam, Bhardwaj said the CSP LEDs would match the performance of leading high-power devices.

For applications that need a tighter beam, and emission only from the top surface, the predominant solution is a reflective coating applied to the sides of the LED. Of course, that coating adds cost and hurts light extraction and therefore efficacy. That coating has led many of the LED vendors to call their CSP LEDs white chips because of the coating on the side.

Commercial availability

Of course, the question that's probably top of mind for SSL product developers is availability. At SIL 2015, Bhardwaj said Lumileds shipped more than a quarter-billion CSP LEDs in 2014. That figure was questioned in the aforementioned SIL panel on CSP technology, but Bhardwaj reaffirmed the total recently and said the company will ship a far greater number this year.

Bhardwaj did say Lumileds is not currently supplying the CSP LEDs in general lighting applications. But the company also supplies automotive, backlighting, and camera-flash application segments with LEDs. And Bhardwaj said CSP LEDs had shipped in each of those three segments - both to customers buying LED components and to others buying Level 2 modules.

Several of the Asian LED vendors have said they have shipped CSP LEDs to customers in the display backlight business. That application came first because those customers were readily equipped with the automated assembly equipment needed to use the LEDs. Moreover, backlight applications don't require the quality of light needed for general lighting applications.

FIG. 4. Samsung believes that CSP technology will allow it to offer developers more flexibility, for example, through 2x2 and 3x3 arrays.

"Backlight units are the best applications in which to get the optimal advantage from CSP's wide overdrive range," said Samsung's Tarn. Moreover, he said general lighting needs improved efficacy relative to the LED used in backlight applications. Tarn maintains the stance he took publicly at LightFair International in May, stating that Samsung will ship CSP LEDs for general lighting around the end of 2015 and will be the first commercial supplier in the general lighting space.

Projected features

With CSP technology poised to enter the general lighting application, let's close by considering what SSL developers might expect in the components. Samsung's Tarn, for example, said his company's architecture in the CSP2 technology will enable flexibility in what he called delivery options. The company has demonstrated CSP LEDs packaged in 2x2 and 3x3 arrays where apparently the LED arrays are created directly at the wafer level (Fig. 4).

Tarn also said Samsung will be able to place a single lens or primary optic on the arrays. Presumably, the combination of the array technology and one lens will offer efficiency through better light extraction along with better quality in terms of beam uniformity and color.

Bhardwaj from Lumileds expounded on similar themes. He said next-generation CSP LEDs will be application specific. He was not willing to discuss how Lumileds will realize new features but said Lumileds will have the ability to tune the radiation pattern. Bhardwaj reaffirmed that CSP LEDs today need work in directional applications, but predicted that within 12 months, the technology will match the performance of legacy high-power packaged LEDs in beam control.

Maury Wright | Editor in Chief

Maury Wright is an electronics engineer turned technology journalist, who has focused specifically on the LED & Lighting industry for the past decade. Wright first wrote for LEDs Magazine as a contractor in 2010, and took over as Editor-in-Chief in 2012. He has broad experience in technology areas ranging from microprocessors to digital media to wireless networks that he gained over 30 years in the trade press. Wright has experience running global editorial operations, such as during his tenure as worldwide editorial director of EDN Magazine, and has been instrumental in launching publication websites going back to the earliest days of the Internet. Wright has won numerous industry awards, including multiple ASBPE national awards for B2B journalism excellence, and has received finalist recognition for LEDs Magazine in the FOLIO Eddie Awards. He received a BS in electrical engineering from Auburn University.