Research projects five years of growth for packaged LEDs and SSL (MAGAZINE)

Bracketing the keynote presentations at Strategies in Light, Strategies Unlimited analysts reported positive developments in the LED component and lighting markets, reports MAURY WRIGHT, with both projected at double-digit growth through 2018.

The Plenary session at the Strategies in Light (SIL) 2014 conference held February 25–27 in Santa Clara, California again featured analysts from Strategies Unlimited presenting their most recent research on the packaged LED component and LED-based general lighting markets. Packaged LED revenue was reported at $14.4B (billion) for 2013 with projection that the total will reach $25.9B in 2018. The general lighting market will grow even more steeply. The SIL presentation focused on LED replacement lamps, with that segment alone generating $4.8B in 2013 and projected to reach $12.2B in 2018. In both cases, the revenue growth will come amongst price decreases with the next five years being an exciting time in the maturing solid-state lighting (SSL) space.

The LED research was focused on packaged components, as it has been in the past. It does not include the sale of bare die. It also excludes products such as infrared (IR) and ultraviolet (UV) LEDs that are sold into industrial, security, and other applications.

The LED research does include chip-on-board (COB) LEDs such as the recently announced Cree CXA1310 pictured in Fig. 1. Analyst Katya Evstratyeva made the point during her presentation that the line between such COB LEDs and other light engine or modular products is blurring. Indeed, many companies use the COB term to describe larger light engines based on printed circuit boards in a variety of form factors. Conversely, some modules look more like a COB LED than a module, such as the new Xicato XTM module.

Evstratyeva said that the research firm is planning a report to address the modules and light engine space. The universe of manufacturers of modular products will be significantly broader than that of packaged LEDs, and that research will surely be of interest.

LEDs by regions

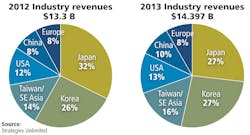

Diving into the packaged LED revenue research, Evstratyeva first broke down the revenue by region and compared 2012 and 2013 data (Fig. 2). There was modest 7% growth in 2013, although as we mentioned previously the ramp will be steeper — projected at 13% CAGR (compound annual growth rate) — going forward. Companies based in Japan remain responsible for the largest sum of global LED revenue. Certainly, market leader Nichia is in part responsible for that country's position, although Strategies Unlimited tracks the five largest LED makers in Japan. The analysts also track five companies in Korea that in aggregate earn the second highest revenues.

Outside of Japan and Korea, however, the story is far more interesting. In the US, for instance, the revenue is generated by only three companies and in Europe only one is tracked. In contrast, Strategies Unlimited tracks 13 companies in Taiwan and nine in China. Those numbers are indicative of the upstarts attempting to win space in what is already a crowded market.

Application segments

Now let's discuss the application segments for packaged LEDs. The Strategies Unlimited team has long broken the market into five segments plus a catchall other category:

• Backlights for displays, monitors, and TVs

• Mobile devices

• Automotive lighting

• Signage

• General lighting

• Other

Fig. 3 depicts these market segments and the contribution of LED revenue that is attributable to each segment. Clearly, the general lighting segment will drive the LED component market going forward. Indeed, general lighting displaced backlighting as the growth driver, as we reported in our SIL coverage last year. Still, all of the segments are significant and worth further discussion.

Given that backlighting has been such a significant market, let's begin in that application. Strategies Unlimited is projecting in a decline in the segment at a 7.74% CAGR from 2013 to 2018. There are several factors that are combining to portend the decline. First of all, the application segment is virtually fully saturated with a transition to LED backlights at this point. Second, brighter LED components mean that in many cases fewer LEDs will be needed to backlight a screen. Third, the price drop in LED components has been especially acute in the mid- and low-power LED space and those are the predominant LEDs used in the application.

Fig. 4 details the backlight segment. The peak in the 2011 to 2012 timeframe came as there were still legacy fluorescent-based backlights in use and more potential for market share gains for LEDs. Still, the projected $1.7B in 2018 is a very significant market.

Mobile applications

Moving to mobile, Strategies Unlimited primarily focuses on mobile phones, including smartphones, and tablets. The mobile sector is projected in a more moderate 2.36% decline (Fig. 5). As with the backlight segment, lower LED prices and brighter components are part of the story.

There are market dynamics, however, that have made the revenue decline for mobile more shallow than for backlight. In many cases, mobile devices have displaced dedicated digital cameras as the primary camera used by consumers. Higher pixel counts in image sensors and lower cost have enabled better cameras in mobile devices. And now the market is demanding better LED-based flash for cameras. We discuss the trend in the companion story on the SIL conference (p. 47). In many cases, mobile device makers are including an LED-based flash on both the forward- and rear-facing cameras in mobile devices.

Evstratyeva said LED revenue sold into flash applications is in the $700M (million) range in 2013. Moreover, she said that sub-segment will continue to rise in revenue through 2018, albeit not at a rate that will eliminate the aggregate projected decline.

Automotive lighting

Now we will transition into growth segments including automotive lighting and signage. There are a number of factors that will keep LED revenue on the rise in the automotive segment. For starters, the market is far from saturated. LED exterior lighting including headlamps has been primarily limited to luxury-level vehicles. But that situation is changing. Evstratyeva noted that Toyota is moving to LED-based headlamps on its Corolla model, which is a smaller economy vehicle.

LED headlamps are also moving beyond stylish cars. Ford recently announced that its best-selling F-150 light-duty truck will get LED headlamps across the model (see p. 9). Ford noted that the durability of LED lighting technology was a good match to the work truck market. Indeed, the company said it fired stones at the headlamp unit in tests. But the company also noted a styling angle and the LED-lit light guide implemented around the perimeter of the unit that the company said will offer a signature look.

Fig. 6 details the interior and exterior sub-segments of the automotive market. The exterior segment will remain the larger of the two, primarily because of the number of different ways that LEDs are used in headlamps, turn signals, brake lights, and other functions. Still, Evstratyeva pointed out the in-cabin potential. She said auto makers are increasingly using LED lighting with features such as color tunability to add styling inside the cabin and to help drive sales.

Signage is also a growth market that totaled $1.8B in LED revenue in 2013 with growth projected to $2.4B in 2018 (Fig. 7). The bulk of the sign manufacturing is taking place in China, so that region is driving the LED purchases. The sign market itself will grow from $4.7B in 2013 to $6.1B in 2018 and that would indicate a market that is far from saturation.

General lighting

And now let's get to general lighting and the largest market for LEDs going forward. Here we will look at both LED revenue trends and at lighting revenues. Moreover, we will consider the types of LEDs being used in general lighting and how specific LED manufacturers are faring in the segment.

The chart in Fig. 8 is a complex one that depicts the revenue forecast for packaged LEDs relative to specific sub-segments of the lighting market. While we regularly write about — and presentations at conferences such as SIL support — the premise that LEDs will fundamentally change the lighting market, presumably the bulb form will begin to disappear in favor of luminaires with integral LEDs or modular SSL engines. And these new luminaires will truly leverage the compact size of LED light sources and the ability to distribute LEDs in arrays to cover large areas. Examples of revolutionary new designs include the planar fixtures based on light guides that are edge lit with LEDs.

LEDs may indeed yet revolutionize lighting product design. But Fig. 8 makes it clear that through 2018 the replacement lamp will be the most widely deployed lighting product consuming LEDs. The graph tells an interesting story. Lamps trailed the aggregate luminaire segment in 2013, although the overall lamps LED revenue was an impressive $1.5B. But soon lamps will account for half of the LED revenue for components sold into lighting. Ironically, socket saturation will happen in the lamps space toward the end of the projection window, and once again luminaires will become the larger sub-segment for LED revenues.

It is worth noting that the replacement lamps segment includes products sold into both residential and commercial applications. Strategies Unlimited includes LED-based linear tubes in the category, for example, and those products target industrial and commercial applications. Likewise, the MR16 sub-segment is mostly based on business customers whereas A-lamps are more prominent in residential applications.

LED lamp market

Taking a deeper look at the lamp market, Philip Smallwood, director of research at Strategies Unlimited, addressed the end product market at SIL. He presented the adoption graph depicted in Fig. 9 that pretty much confirms the LED research data in Fig. 8, the blue arrow standing for the penetration of LED lamps with regard to the total global installed base. The LED lamp market today is at the earliest stages in terms of technology adoption. Smallwood asserted that we haven't even reached the early adopter stage at this point.

Still, the lamp market has racked up some impressive revenues. In aggregate lamps revenue totaled $4.8B in 2013. Smallwood projected growth to $12.2B in 2018 — a 21% CAGR (Fig. 10). What you may find surprising is that the MR16 segment is the largest segment at the moment and will continue to be so until A-lamps catch up in the 2015 to 2016 timeframe.

There are several factors at play in the size of the MR16 sub-segment. For starters, the lamps are primarily deployed in business applications, as mentioned before. And businesses have adopted LED lighting more quickly than residential consumers. There also have been many low-quality MR16 lamps made in China and sold into markets such as Russia. Smallwood said as many as 50M MR16 lamps were sold in Russia in 2013.

The MR16 sub-segment is also instructive of what will happen across the lamps market because it is a year or two in front of the other sub-segments in terms of adoption. Fig. 11 shows that in the 2017–2018 timeframe socket saturation will impact MR16 lamps sales with a decline in revenue inevitable.

Conversely, Smallwood projects A-lamp revenue at $5.2B in 2018, exceeding MR16 revenue and still on a growth path at that point. But saturation will happen soon after, and with the long LED lifetime the lamps market will decline considerably. Smallwood said that North America has been consuming 1.1 replacement lamp per year based on legacy incandescent and compact-fluorescent technology. That per-year unit volume will be slashed by LED lifetime.

Smallwood also had an interesting outlook on the LED-based tube market, which as Fig. 10 shows is substantial but probably not as large as the participants in that space would hope based on the huge installed base of linear fluorescent lamps around the globe. While many prognosticators, including the US Department of Energy (DOE), have questioned the lighting quality produced by LED tubes, Smallwood based his thoughts on the incumbent technology. He said T8 and T5 fluorescent tubes perform well and the efficiency advantage of LEDs is not significant enough to spur a broad retrofit wave.

LED luminaires

Let's briefly consider the state of the LED luminaire market. While comparing lamps and luminaires in terms of packaged LED revenue revealed that lamps were the larger segment, the opposite is true in terms of revenue of the lighting products. Consider Fig. 12. Luminaire revenues totaled $11.7B in 2013 and will grow to $21.3B in five years. Luminaires are simply much more complex products with more expensive subsystems such as driver electronics and housings. And LEDs with dropping component prices represent an increasingly smaller portion of the bill of materials cost for both lamps and luminaires.

The luminaire market is predominantly driven by four sub-segments. Architectural or façade lighting outdoors has been an early area of success due to both the energy savings associated with LEDs and dynamic color capabilities. Outdoor street and area lighting is a prime sub-segment because those products burn all night, and energy and maintenance savings are critical. Likewise, the commercial and industrial sub-segments are very focused on energy and maintenance savings and, more recently, the quality of light that LED sources can deliver relative to fluorescent and high-intensity discharge (HID) sources.

Success in lighting

Having covered the lighting products, let's return to a final discussion focused on LEDs relative to lighting applications. First, we will look at how well the LED manufacturers are penetrating the general lighting market. Strategies Unlimited does not break such data out per individual LED manufacturers, but we can make some inferences based on Fig. 13, and the discussion we had based around Fig. 2 and the number of LED makers that Strategies Unlimited tracks in each region.

In perhaps a surprising fact, Evstratyeva reported that LED makers in the US accounted for the majority of the LED revenue sold into lighting in 2013. The bulk of that revenue is surely attributable to Cree. While the company is only the sixth-largest LED supplier based on revenue for 2013, Cree is perhaps the top supplier in lighting applications and has taken good advantage of its early focus on the lighting application segment.

The real question is how the lighting market will proceed going forward. And much of that discussion could hinge on the types of LEDs used in various lighting products. Strategies Unlimited continues to segment the LED market into low-power, mid-power, high-power, and super-high-power sub-segments. The key differentiating point has been the line in the middle where mid-power LEDs are operated at 0.5W and below and high-power LEDs in the 0.5W to 5W range. High-power LEDs have been dominant in lighting applications.

LED categorization

The boundary between mid- and high-power LEDs has also been neatly aligned with plastic or hybrid-plastic packages used in the lower-end LEDs and more-reliable ceramic packages being used in higher-power devices. But the boundary lines are being crossed from every perspective. Mid-power LEDs are being operated at power levels above 0.5W and increasingly include architectural elements that were developed first in high-power LEDs. For example, Philips just announced high-voltage mid-power LEDs (p. 10), and added epoxy-molded-compound packages that should deliver better reliability. Cree continues to push ceramic packages into smaller footprints — smaller than mid-power LEDs — while delivering the luminous flux of larger high-power LEDs.

Evstratyeva readily admitted in her SIL presentation that new thinking was needed in the area of segmenting the LED market by type of device. Still, she presented some projections based on the conventional segmentation tied to power level. And the results were surprising to some in the audience.

For example, consider the replacement lamps market depicted in Fig. 14 segmented by LED type. Strategies Unlimited projects high-power LEDs to remain dominant in terms of revenue in the retrofit lamps segment. A number of attendees at SIL questioned that projection in networking events after the Plenary session.

We'd speculate, however, that the devil is in the details. If you stick with a categorization based on power level, then LEDs packaged in a plastic or hybrid-composition package, and that operate above the 0.5W level, are in the high-power category. Moreover, remember that the breakdown is based on LED revenue and not unit volume. High-power LEDs sell at higher price levels; therefore, the products that use high-power LEDs will contribute more to the high-power category measured by revenue.

The surprising angle to the category-based breakdown is the increasing prominence of COB LEDs across many different lighting applications. Some in the industry have the mistaken idea that COBs deliver more uniform light. In reality a careful optical design can almost always deliver better optical performance with discrete emitters. The fact is that COBs are easier to design into products. Driving the COBs is easier and the thermals are in part handled in the LED package. Coming out of SIL the prevailing thought was that you should expect COBs in virtually every lighting application, with lighting manufacturers trading simplicity of product development for less-precise beam control.