As one pioneer exits the arduous and long-fledgling smart lighting market, another has revamped its approach in hopes that rebranding itself as a technology company — more so than as a lighting outfit — can help attain the steady flight that has eluded any company chancing its hand at Internet-connected illumination.

Acuity Brands, an early champion of in-store, lighting-based location services which as far back as 2015 installed pilot implementations at Target retail stores, had little to say in the last couple of years about Atrius — a collection of hardware, software, services, and partnerships that had become the centerpiece of its IoT approach.

But with the launch of its new Intelligent Spaces group, Acuity is now talking the “connected” and “data” talk again. Loudly.

Atlanta-based Acuity first mentioned Intelligent Spaces a month ago, when it acquired Seattle-based Rockpile, describing Rockpile as an incubator of artificial intelligence startups.

Yesterday, it featured Intelligent Spaces prominently in an online Investors Day presentation and in announcing a company-wide year-on-year 15.9% increase in sales for the fiscal third quarter ended May 31 to $899.7 million, when net income jumped 42% to $85.7M.

While the activities that now compose the new Intelligent Spaces comprised only $55.4M of the $899.7M in revenue, Intelligent Spaces is clearly at the heart of the company's plans to drive revenue through services.

“Our strategy for winning the next decade is very clear,” CEO Neil Ashe said in a video. “We're going to increase the service levels in the industry. We're going to increase the amount of technology both in our products and in how we provide those services.”

While the company's lighting and controls division — Acuity Brands Lighting (ABL) — is very much a part of that plan as it embeds sensors in luminaires to facilitate services, Intelligent Spaces appears to be the soul of the new services machine.

Yesterday was the new division's official coming out, when Acuity reiterated (as it told LEDs Magazine last month) that Intelligent Spaces consists of Atrius plus the Distech Controls group, which focuses on building controls including lighting as well as heating and cooling and others. Acuity's website also lists DGLogik, an IoT applications development company, as part of Intelligent Spaces.

Somewhere along the way Acuity had referred to the group as “Intelligent Buildings,” but with the acquisition of Rockpile and the appointment of Rockpile co-founder Peter Han as the group's president, Acuity changed the name to Intelligent Spaces. It has made other adjustments as well. For example, building analytics unit Lucid no long exists by name, as the reshaped Intelligent Spaces has subsumed its mission.

Acuity has in the last couple of years also had several key management changes, with the former head of IoT lighting Greg Carter leaving in 2019, and his replacement, Audwin Cash, subsequently departing. In January 2020, Ashe replaced Vernon Nagel as CEO.

The idea of Spaces is, as Han told LEDs Magazine, to outfit buildings and other places with “edge to cloud” technology that smartens up operations in several ways, especially in energy management and in location services and asset tracking.

A building equipped with Acuity Intelligent Spaces products or services might, for example, have sensors that detect when the temperature or lighting is too high or low, and then carry on changes to climate and lighting settings. A retailer might keep tabs on warehouse inventory or on stock inside a store.

Such benefits are not new to the marketing campaigns of the smart lighting industry. But deployments have been more rare than the rhetoric across the industry, to the point where another smart lighting pioneer, Gooee, recently went bust.

To increase the prospects for Intelligent Spaces, Han told LEDs that the technology will not necessarily always entail lighting.

“It's a broad world,” he said.

To that end, it's notable that “Intelligent Spaces” does not include the word “lighting.” Nor does Acuity's new tagline: “an industrial technology company.” The first thing that Acuity invites visitors to do on its freshly rebranded website is to “access transformational technology through our businesses,” a hook that avoids the “L” word. The very top of the new homepage quickly nods at lighting, noting, “We use technology to solve problems in spaces, light and more things to come,” but puts the “T” word in pride of place.

As Acuity morphs into more of a technology company that is not always woven into a lighting mission, it hopes to avoid the fate of Gooee, which had itself attempted the same alchemy.

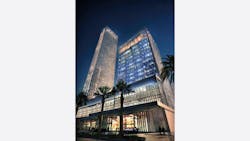

The presence of Distech, which is steeped in control experience both inside and outside of lighting, could be a cornerstone. Distech has contracts in locations including General Motors headquarters in Detroit, Stanford University, Singapore's Maritime and Port Authority, Kuwait City's Burj AlShaya Towers, Shanghai's One Museum Place office tower, and many others.

Acuity appears to have built up a comparatively decent share of the smart lighting market. At one point in 2019 Acuity had grown its presence in Target to many of the then-1845 retail outlets.

Whether the Rockpile acquisition will bring any killer apps into the Acuity stable remains to be seen; Acuity is not revealing much about the Rockpile portfolio.

None of this is to say Acuity is exiting lighting. Under the direction of ABL president Trevor Palmer, the lighting group with its many brands of luminaires racked up $850M of the quarter's $899.7M sales, according to an Acuity press release (the company's stated $850M for ABL plus $55M for Intelligent Spaces exceeds the company total of $899.7M; LEDs will try to get clarity). The overall increase in revenue and profits seemed to defy the pandemic economy.

“Even in a pandemic, people need lights,” Palmer told LEDs, noting that with the exception of retail, sales were lively across the company's sectors, with commercial and industrial projects strong, electrical contractors buying, and schools refitting. CEO Ashe pointed out that industrial warehouses took the opportunity to transition to new lighting. The Acuity website identifies 21 brands in the ABL stable.

Meanwhile, to help Acuity chase the connected business, CEO Ashe said that it is planning more acquisitions to go along with its two pickups so far this year — Rockpile and a chunk of ams Osram's Digital Systems business, a deal that closed yesterday.

MARK HALPER is a contributing editor for LEDs Magazine, and an energy, technology, and business journalist ([email protected]).

♦ Acuity Brands' nLight, Eureka Lighting, Luminis, and A-Light brands have been been named finalists in our 2021 Sapphire Awards program. See who else made the shortlist and register to attend the virtual Strategies in Light event to cheer on the winners on Aug. 24, 2021. ♦

For up-to-the-minute LED and SSL updates, why not follow us on Twitter? You’ll find curated content and commentary, as well as information on industry events, webcasts, and surveys on our LinkedIn Company Page and our Facebook page.

Mark Halper | Contributing Editor, LEDs Magazine, and Business/Energy/Technology Journalist

Mark Halper is a freelance business, technology, and science journalist who covers everything from media moguls to subatomic particles. Halper has written from locations around the world for TIME Magazine, Fortune, Forbes, the New York Times, the Financial Times, the Guardian, CBS, Wired, and many others. A US citizen living in Britain, he cut his journalism teeth cutting and pasting copy for an English-language daily newspaper in Mexico City. Halper has a BA in history from Cornell University.