DOE estimates energy-saving potential of LEDs in general lighting through 2030

The forecast predicts that by 2020, LED lamps and luminaires will have primarily penetrated the commercial and outdoor stationary applications. Proliferation into residential, industrial, commercial and outdoor stationary markets will occur in the 2020-2030 timeframe.

The forecast projects LED lamp and luminaire sales measured in lumen-hours. The analysis indicates that LED lighting in general illumination applications has the potential to represent 36% of sales measured in lumen-hours on the general illumination market by 2020 and 74% of sales by 2030.

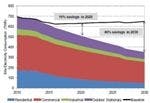

According to the Energy Information Administration (EIA), the US consumed 694 TWh of site electricity in 2010 on lighting - approximately 18% of all electricity used. The model demonstrates the total energy consumption for lighting could be reduced by 19% by 2020 and by 46% by 2030 relative to a scenario with no additional LED lamps or luminaires beyond what is installed today (baseline curve in Fig. 1).

By 2030, the annual energy savings from market penetration of LEDs will be approximately 297 TWh, enough electricity to power 24 million homes. At current energy prices, that equates to $30 billion in savings in the year 2030. Assuming the same mix of power stations, these savings, according to the report, would reduce greenhouse gas emissions by 210 million metric tons of carbon in 2030.

New, improved study

The DOE has published this report four times, in 2001, 2003, 2006 and 2010. Several important changes to the 2010 methodology have been implemented. First, the 2010 baseline data now uses the DOE’s recently published 2010 US Lighting Market Characterization (2010 LMC) inventory report. That report showed that 67 million LED lamps and luminaires were installed in the US in 2010, accounting for 0.8% of the total.

The model includes lighting in residential, commercial, industrial and outdoor stationary applications. The previous reports then grouped lamps by high- and low-CRI application. Now the lamps are grouped by submarket in which different technologies compete, including five categories: general service lamps (medium screw base), reflector lamps (screw base), HID, linear fluorescent and miscellaneous.

Performance, price, lifetime targets

An econometric model used in the analysis relies on assumptions of efficacy, retail price and operating life. These estimates were based on work conducted collaboratively by the DOE and industry experts, including members of the Next Generation Lighting Industry Alliance, an SSL technical working group managed by the National Electrical Manufacturers Association.

LED performance assumptions are based on the DOE’s SSL R&D multiyear program plan (MYPP) and its SSL R&D manufacturing roadmap through 2020. Values for 2030 were extrapolated based on the prevailing trend. LED lamps and luminaires were modeled separately, which was not done in previous studies. The model assumes an average efficacy of 37 lm/W for an LED lamp and 70 lm/W for an LED luminaire in 2010, which is expected to increase to 182 lm/W and 193 lm/W, respectively, in 2020 and 203 lm/W for both product types in 2030.

The model assumes the price (in $/klm) for LED lamps will decrease from $55.16/klm in 2010 to $6.28/klm in 2020 and to $3.34/klm in 2030. For LED luminaires, price is expected to drop from $180.88/klm in 2010 to $23.69/klm in 2020 and to $12.73/klm in 2030.

The report noted that the best LED lamps and indoor luminaires have lifetimes in the 25,000-hour range, while outdoor luminaires have lifetimes of 50,000 hours. These lifetimes are expected to increase to 50,000 hours for LED lamps and indoor luminaires by approximately 2020, and to 75,000 for outdoor luminaires by approximately 2020, when both lifetime estimates hit a plateau.

The model of adoption rate of LED technology considers both first cost of LED lamps and luminaires as well as annual maintenance and operating cost, which together represent life-cycle cost.

By 2030, the energy-savings potential is greatest in the commercial sector, followed by the residential sector, which contribute 37% and 34% to the total energy savings. Outdoor stationary applications make up the next largest sector, at 25% and industrial makes up 4% of the total. A breakdown of forecasted savings in 2030 (Fig. 2) shows that the replacement of linear florescent lamps in commercial applications, HID in outdoor applications and incandescent bulbs in residential applications represent some of the most significant opportunities for energy savings from LED implementation.