Semicon West delivers technology update on LED manufacturing (MAGAZINE)

+++++

This article was published in the September 2011 issue of LEDs Magazine.

View the Table of Contents and download the PDF file of the complete September 2011 issue.

+++++

An LED-centric theme continued to simmer at Semicon West, the annual semiconductor-industry tradeshow that took place July 12-14 in San Francisco, CA. The manufacturing-oriented event included a day-long LED program presented in the Extreme Electronics pavilion called “More lumens per dollar: Issues and answers to bring costs down to create a general lighting market.” Speakers from LED manufacturers, equipment manufacturers, materials companies, universities, and analyst organizations addressed efficiency droop, MOCVD developments, new packaging schemes, and even novel epitaxial layer transfers that could all lead to more affordable solid-state lighting (SSL).

LED manufacturing technology was still decidedly in the minority on the huge show floor given the breadth of the show focus. The LED session provided broad coverage that introduced the SSL concept and opportunity to the semiconductor crowd, while also digging deeper into manufacturing better, less-expensive LEDs for the SSL converts in the crowd. We’ll skip the details on LED market opportunity and SSL basics here as we’ve covered those topics extensively – for example in our Strategies in Light coverage – and will focus instead on LED manufacturing.

Identifying droop culprit

Manos Kioupakis, a postdoctoral researcher at the University of California at Santa Barbara (UCSB), presented university research focused on identifying the cause of the droop phenomenon in LEDs. Droop has long puzzled the high-brightness (HB) LED community. At low currents, LEDs can exhibit efficacy well in excess of 200 lm/W, but at the high drive currents used for HB LEDs in general-illumination applications, the efficacy drops considerably. Indeed phosphor-converted white LEDs being shipped today are generally in the 100 lm/W range with some besting that number.

The UCSB researchers don’t claim to have solved the droop problem but to have identified the cause. Indeed researchers have long debated the cause. The leading theories are carrier leakage and Auger recombination. Carrier leakage occurs when charge-carrying electrons escape the active quantum-well region in an LED where light is produced. Auger recombination is a complex phenomenon found in semiconductors where energy is transferred among three carriers with the third ultimately losing the energy that, in the case of LEDs, would generate light.

Kioupakis and his team performed a theoretical evaluation of Auger loss. The key finding according to the team is that indirect Auger loss is the major culprit. Indirect Auger loss is caused by the scattering of charge carriers whereas most other research on the phenomenon has focused on direct Auger loss that has been judged to have a relatively small impact on efficiency.

Presuming their identification of the droop cause is correct, the team is now trying to solve the problem. The researchers believe the answer lies in reducing carrier density through thicker quantum wells, more quantum wells, and non-polar and semi-polar growth.

Reducing MOCVD costs

Bill Quinn, chief technologist at Veeco Instruments, focused his presentation on trends in MOCVD (metal organic chemical vapor deposition) systems that can reduce the cost of making HB LEDs. Quinn said, “The color, the brightness, and the electrical properties are all determined by the MOCVD.” And of course MOCVD tools impact device costs significantly since as Quinn said the tools make up more than 50% of the capital expenditure on a new LED fab.

Despite the high cost, Quinn said that MOCVD remains the best choice for manufacturing LEDs compared to other deposition technologies. He noted the readily-available precursors and high GaN growth rates as advantages and said the tools are easily scalable to 8-in wafers.

The key to lower cost is faster epitaxial processing. Companies such as Veeco have attacked that problem by developing reactor chambers that can handle more wafers simultaneously – as many as 54 2-in wafers in Veeco’s case. They are also offering clusters of two to five chambers than can share infrastructure, such as the precursor supply, thereby lowering the total cost of ownership.

Quinn said that Veeco had researched other challenges to reduce prices, and yield takes the number one position. In the case of LEDs, yield doesn’t mean an LED that works or doesn’t. Rather it means manufacturing an LED that meets tight specifications in color, brightness, and forward voltage.

Veeco has found that better temperature and chemical-flow control can improve yields. In one new approach to better temperature control, the company is using a pyrometer to monitor temperature at the growth layer rather than relying on wafer temperature.

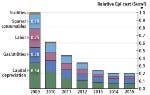

Quinn projects steady progress in MOCVD reactors. He said, “By 2015, continuing on the path we’re on with MOCVD improvement, we can get down to a relative epi cost of about 20% of where we were in 2009.” (See Fig. 1) That translates to a 3× to 4× reduction in LED cost over the same period, said Quinn.

Centralizing precursor delivery

Thiloma Perera, director of marketing at Dow Electronic Materials, discussed a different approach to optimizing reactor throughput. Dow has developed what it calls a Vaporstation (Fig. 2) that enables centralized vapor-phase delivery of precursors to multiple reactors.

Today, most reactors rely on chemicals stored at each reactor or cluster in metal cylinders that are commonly called bubblers. According to Perera, that approach wastes floor space, increases labor costs, and creates downtime. The reactors must include temperature-controlled baths in which the bubblers are stored – these significantly increase the footprint of the system.

But the larger problem comes when a chemical runs low. Perera said, “You have to stop your reactor, change the bubbler, and then start it again. This takes anywhere from 4 to 24 hours.” The long restart time is in part due to the time it takes to stabilize the process.

Dow’s approach eliminates this downtime. There are many possible configurations that can support varying numbers of reactors or clusters. But in any scenario there is always a secondary supply of the precursor that takes over when one runs low. Perera said that one customer is running 11 reactors on one Vaporstation.

Perera admitted that it will take time to bring about the cultural change within LED manufacturers, who would have to transition from a system that has worked successfully. But she insisted it will reduce the cost of ownership of a reactor through lower labor costs and better throughput. Perera said savings from using the centralized system would be highly dependent on each installation. However, Dow believes the system could save $200,000 to $300,000 in operating cost per reactor per year, and that a throughput improvement would come on top of those savings.

Perera also said that the centralized system is safer since most of the precursors are pyrophoric, meaning they will spontaneously ignite if exposed to air. She said that every time a bubbler is changed there is a potential for an accident that would be greatly lessened by moving to a centralized system.

Dicing and packaging

Taking a much broader look at the cost of making LEDs, Yole Developpement senior market and technology analyst Eric Virey presented 20 research areas that could deliver significant advancements in either lower manufacturing cost or better LED performance (meaning essentially more lumen output). He identified larger-diameter wafers and alternative substrates such as silicon as having the most potential for big cost reductions. Solving current droop, as discussed earlier, ranked as having the most significant potential on the performance axis.

Virey, however, chose to focus his presentation on three other areas where there’s near-term potential for gains on both axes:

- Die singulation

- Wafer-level packaging

- Thermal management

There are four primary methods now used for die singulation – blade dicing, laser dicing, diamond scribing, and laser scribing. The scribing methods require a breaking step once the scribing is completed.

Virey identified a couple of laser-based approaches that might bring about improvements. He noted that to increase throughput, you can’t just use a higher laser-dicing speed because that requires higher laser energy and results in component damage. Instead you can split a laser beam creating a serial or in-line multibeam. He also described a parallel system where multiple beams scribe dicing lines simultaneously. He said a 6× improvement in scribing speed would yield double the wafer throughput.

In the thermal-management area, Virey showed examples from all of the major LED vendors in terms of packaging and materials that can conduct heat away from the LED. He moved quickly to a focus on wafer-level packaging (WLP) that it turns out addresses both thermal and packaging issues.

WLP is a concept intended to optimize the back-end of the LED manufacturing process. You still must singulate the LED die, but then bond each to a silicon packaging wafer. The manufacturer can then perform phosphor coating, optic installation, and other processes to a wafer of LEDs rather than one by one before the individual components are once again separated.

Virey said that WLP can decrease cost and increase reliability based on monolithic assembly, silicon thermal conductivity, and copper-filled through-silicon vias (TSVs) to connect the anode and cathode, and to provide heat conduction. However, he also said that TSVs add expense. Note that at Semicon West, ESI announced a new packaging system that uses a laser to drill TSVs.

Epi layer transfer

TSVs were also a key theme for Ram Trichur, director of the LED/Energy Devices strategic business unit at Brewer Science. Trichur focused on thin-wafer-handling technology. According to Brewer, it can be advantageous to transfer the epitaxial layer from the growth substrate to an electrically- and thermally-conductive substrate. Doing so provides even current distribution through the MQW active region, and better heat dissipation. And a manufacturer can reuse the growth substrate after transferring the epi layer.

To enable such a transfer, the manufactured wafer is bonded temporarily to a carrier wafer attached to the epi side. The original substrate is then removed, and the epi layer is attached to a new substrate made from copper or a metal alloy. Brewer makes the tools and materials that enable the temporary bond t o withstand chemicals and high-temperature processes. The technology allows safe removal of the carrier with no damage to the components.

Trichur showed a sample application in which the LED chip is ultimately mounted on a silicon sub-mount or interposer layer (Fig. 3). Copper-filled TSVs provide both electrical and thermal conductive paths. The silicon layer is mounted to the alloy layer such as aluminum nitride (AlN). Trichur said that Brewer has a new alpha-stage technology called ZoneBond that will allow debonding at room temperature and support wafers as large 300 mm.